Programmable CBDC in China Raises Privacy Concerns

[ad_1]

A recent whitepaper by two financial behemoths has endorsed using programmable CBDCs in one of the world’s largest economic zones. However, it raises considerable concerns about privacy and financial freedom.

China’s Greater Bay Area (GBA) generally includes Guangdong, Hong Kong, and Macao. With a population of around 71.2 million, it is 5% of China’s total population and is South China’s wealthiest region.

What Are Programmable CBDCs?

Programmable CBDCs are digital currencies incorporating embedded programmable features, enabling potential control over spending conditions. The increased surveillance and control they introduce raise concerns about privacy and financial freedom.

Authorities can track and monitor transactions, impose restrictions, and potentially curtail individual financial autonomy. This prompts questions about privacy rights, personal liberties, and the potential for abuse of power.

The report makes observations and recommendations that worry most privacy and freedom activists.

For example, at one point in the document, Richard Li, Deputy CEO of Standard Chartered Bank China, says that CBDCs backed by central banks could enable “programmable banking services.”

The whitepaper continues:

“Programmable banking could not only enable automated banking services, but also help to integrate traditional banking with other industries’ offerings and value chains.”

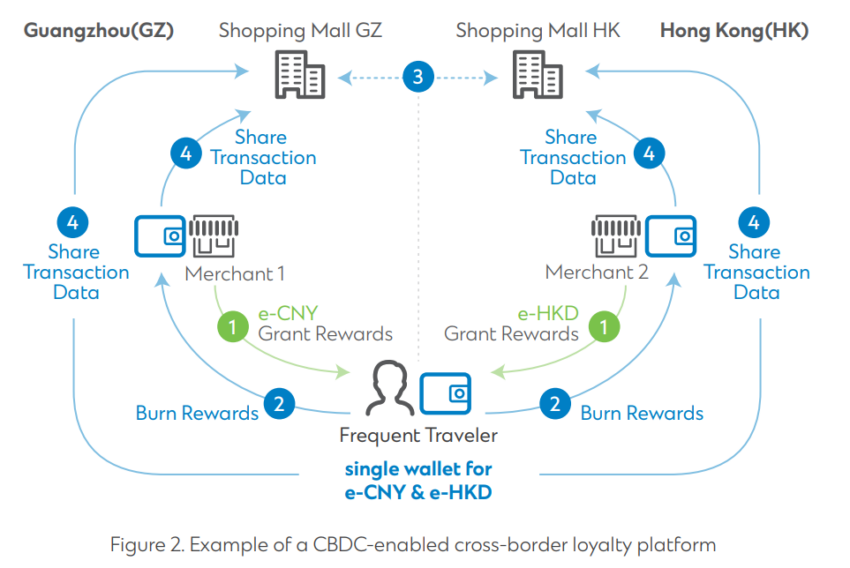

The whitepaper also touches on the subject of loyalty programs across the GBA. Merchants with loyalty programs in all three face complexity and costs in implementing cross-border programs, leading to separate programs under the same brand.

This inconvenience limits the collective use of rewards and hinders customer loyalty. However, “a CBDC programmed to be payable only to specific merchants could be a solution to this,” reads the report.

“If the CBDC is programmed to work cross-border, it could help merchants to bridge their established loyalty programs in different jurisdictions.”

Should We Be Concerned About Privacy?

A programmable CBDC is a nightmare scenario for many in the crypto community. However, not everyone is convinced they pose a threat to our privacy.

Frederik Gregaard, CEO of the Cardano Foundation, told BeInCrypto earlier this year that “privacy is not the problem,” with programmable CBDCs.

Other parts of the world have clarified that they won’t be making their CBDCs programmable.

The EU’s European Central Bank confirmed to BeInCrypto that, despite earlier comments by its chief, it would not “set any limitations on where, when, or to whom people can pay with a digital euro.” The UK has also said its own digital pound will not be programmable.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link