Samsung secures $6.4B grant from US gov’t to expand chip manufacturing in Texas

[ad_1]

Share this article

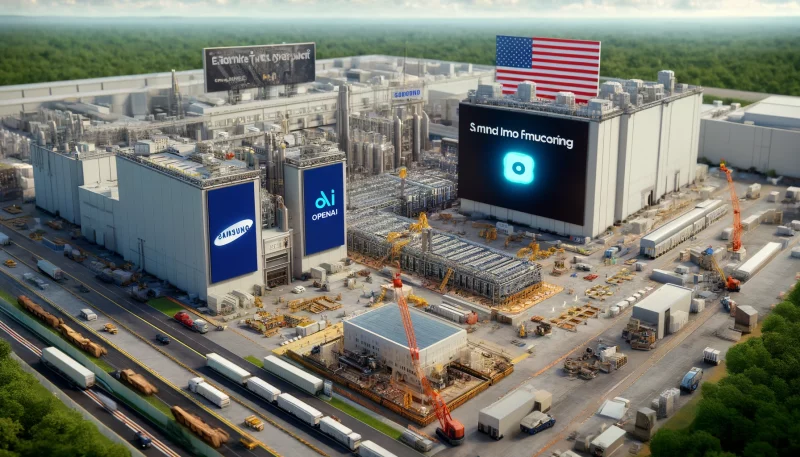

Samsung, the South Korean manufacturing giant, has secured $6.4 billion worth of grants from the United States government to expand its chip manufacturing facilities in Texas. The funding, which comes from the 2022 Chips and Science Act, aims to boost chip production for the automotive, aerospace, and defense industries, as well as to bolster national security, according to a report by Reuters on April 15.

“[The grants] will allow the U.S. to once again lead the world, not just in [semiconductor design], which is where we do now lead, but also in manufacturing, advanced packaging, and research and development.”

In addition to the government grants, Samsung plans to invest another $45 billion in the expansion of its Texas chip manufacturing facility by the end of 2030. This move comes at a time when the global chip shortage continues to impact various industries, including the rapidly growing artificial intelligence (AI) sector.

OpenAI, the creator of the popular AI chatbot ChatGPT, is reportedly planning to produce its own semiconductor chips for its AI applications. The company may be receiving funding from the United Arab Emirates state-backed group MGX to support this endeavor, highlighting the increasing demand for specialized chips in the AI industry.

The chip shortage has also become a pressing concern for the Bitcoin mining industry, particularly as the upcoming Bitcoin halving approaches. In its 2023 annual report, Bitcoin mining firm Riot Platforms outlined 12 continued risks for Bitcoin mining profitability, with the shortage of chip supply being among the most significant. The report also stated that the ongoing global supply chain, as compounded by the increased demand for chips has created a shortfall for semiconductors.

Similarly, US Bitcoin miner CleanSpark cited potential “cryptocurrency hardware disruption” and possible difficulties obtaining new hardware in its 10-K filing for 2023. The chip shortage could impact the profitability and growth of Bitcoin mining operations, as miners rely on specialized hardware to maintain their competitive edge.

As the government and private companies like Samsung work to address the chip shortage through increased domestic manufacturing and significant investments, the Bitcoin mining industry will need to navigate the challenges posed by the limited supply of semiconductors. The upcoming Bitcoin halving, which is expected to occur this week, may further exacerbate the pressure on mining firms to secure the necessary hardware to remain profitable in an increasingly competitive environment.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

[ad_2]

Source link